Starting a business in 2025 comes with unique financial challenges and opportunities. Young entrepreneurs today face a rapidly evolving economic landscape shaped by new technologies, changing market dynamics, and post-pandemic realities. Understanding how to manage your finances effectively is the single most important factor that will determine whether your business thrives or struggles in today’s competitive environment.

The financial tools available to entrepreneurs have transformed dramatically in recent years. Digital banking, AI-powered accounting software, and blockchain-based payment systems have made financial management more accessible than ever before. Yet many young business owners still struggle with cash flow problems, investment decisions, and funding options.

This guide will walk you through the essential financial strategies that successful young entrepreneurs are using in 2025. From establishing solid financial foundations to leveraging the latest fintech solutions, we’ll cover practical steps you can take today to secure your business’s financial future.

Key Takeaways

- Strong financial management forms the foundation of any successful business venture in today’s economy.

- Mastering cash flow and using technology-driven financial tools gives entrepreneurs a significant competitive advantage.

- Strategic investment decisions and risk management practices protect business growth during economic uncertainty.

Understanding Financial Foundations

Every successful business venture requires a solid understanding of financial basics. These foundations include setting realistic goals, creating functional budgets, maintaining accurate records, and preparing for unexpected expenses.

Setting Clear Financial Goals

Financial goals provide direction for young entrepreneurs in 2025. Goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Short-term goals might include reaching $5,000 in monthly revenue or reducing operating costs by 15% within six months. Long-term goals typically focus on bigger achievements like hitting $100,000 in annual profits or expanding to a second location by 2027.

Each goal requires clear metrics for tracking progress. For instance, a young entrepreneur might use this framework:

| Timeframe | Financial Goal | Metric | Target Date |

|---|---|---|---|

| Short-term | Increase profit margin | 5% improvement | December 2025 |

| Medium-term | Build business credit score | Reach 700+ | June 2026 |

| Long-term | Secure angel investment | $250,000 | January 2027 |

Regular review of these goals helps entrepreneurs stay focused and make necessary adjustments.

Building a Budget for Entrepreneurs

Start with identifying all revenue streams, including:

A comprehensive budget serves as the financial blueprint for any business. In 2025, digital tools make this process more streamlined than ever.

- Primary products/services

- Secondary offerings

- Passive income sources

- Potential partnerships

Next, categorize expenses into fixed costs (rent, subscriptions, insurance) and variable costs (materials, marketing, contractors). The 50/30/20 rule offers a starting point: 50% for essential business operations, 30% for growth initiatives, and 20% for savings and debt reduction.

Modern budgeting apps like Novo Business, Lili, and Mercury provide specialized features for entrepreneurs. These platforms offer real-time cash flow monitoring and category-specific insights that traditional banking cannot match.

Tracking Income and Expenses

Accurate financial tracking forms the backbone of business decision-making. Cloud-based accounting software has become the standard for entrepreneurs in 2025.

Programs like QuickBooks, Xero, and Wave automatically categorize transactions and generate detailed reports. These tools also support digital receipt capture, eliminating the need for physical storage.

Effective tracking requires consistency. Entrepreneurs should establish a weekly finance review routine that includes:

- Reconciling accounts

- Categorizing new transactions

- Reviewing upcoming payment obligations

- Identifying any unusual patterns

Tax preparation becomes significantly easier with proper tracking. Most accounting platforms now offer AI-powered tax suggestions that identify potential deductions based on industry norms.

The Importance of Emergency Funds

Emergency funds provide critical protection against business disruptions. The recommended baseline in 2025 is 3-6 months of operating expenses.

These funds should be kept in high-yield business savings accounts that offer both liquidity and modest returns. Current rates average 3.8% for business-specific accounts, significantly higher than traditional options.

Beyond basic emergency savings, entrepreneurs should consider targeted reserves for:

- Equipment replacement: Technology typically requires updating every 2-3 years

- Market downturns: Industry-specific fluctuations can temporarily reduce revenue

- Growth opportunities: Having capital ready for unexpected chances to expand

Building these funds requires discipline. Most financial advisors recommend automating transfers of 5-10% from each revenue deposit until targets are reached.

Managing Business Finances in 2025

Managing your business finances effectively is crucial for sustainable growth in today’s digital economy. Smart financial management can mean the difference between thriving and merely surviving as a young entrepreneur.

Choosing the Right Business Structure

In 2025, selecting the appropriate business structure remains a foundational decision for entrepreneurs. Sole proprietorships offer simplicity but provide no personal liability protection. LLCs have become increasingly popular due to their flexibility and limited liability benefits.

Corporations provide maximum protection but involve more paperwork and potential double taxation. The newer benefit corporation structure allows companies to pursue both profit and social good simultaneously.

Digital nomad entrepreneurs should consider location-independent structures like Wyoming or Delaware LLCs that offer strong privacy protections. Many states now offer streamlined online registration processes that take less than 24 hours to complete.

Tax implications vary significantly between structures. Consulting with a tax professional familiar with digital businesses can save thousands in the long run.

Setting Up Business Bank Accounts

Modern business banking has evolved beyond traditional institutions. Digital-first banks like Mercury, Novo, and Brex offer specialized business accounts with minimal fees and entrepreneur-friendly features.

These platforms typically include:

- Real-time transaction notifications

- Automated categorization of expenses

- Integration with accounting software

- Virtual cards for team spending

- Cash flow forecasting tools

Most digital banks now offer AI-powered insights that identify spending patterns and suggest optimization opportunities. When selecting a bank, entrepreneurs should prioritize those offering open API access for custom integrations with other business tools.

Mobile-only banking has become mainstream, with many institutions eliminating branch requirements entirely. This shift has made banking more accessible for entrepreneurs regardless of location.

Separating Personal and Business Finances

Maintaining strict separation between personal and business finances is no longer just good practice—it’s essential. Using dedicated business accounts creates a clear audit trail that simplifies tax preparation and strengthens liability protection.

Entrepreneurs should:

- Pay themselves a consistent salary instead of taking irregular draws

- Use separate credit cards for business expenses

- Document all transfers between personal and business accounts

- Keep receipts for all business purchases

Modern expense tracking apps like Expensify and Receipts by Wave use AI to automatically capture and categorize receipts. This technology has improved significantly, with 98% accuracy in receipt data extraction.

Business credit cards now typically offer specialized rewards relevant to entrepreneurs, such as higher points on software subscriptions and digital advertising purchases rather than traditional travel benefits.

Mastering Cash Flow

Cash flow is the lifeblood of any entrepreneurial venture. Understanding how money moves through your business helps prevent shortfalls and creates opportunities for strategic growth in today’s 2025 market.

Forecasting Revenue and Expenses

Creating accurate financial forecasts requires analyzing historical data and market trends. Young entrepreneurs should start with a basic 12-month cash flow projection that outlines expected income and expenses.

Key forecasting tools for 2025:

- Digital forecasting platforms with AI capabilities

- Rolling 90-day forecasts updated weekly

- Scenario planning (best case, worst case, most likely)

Many entrepreneurs make the mistake of being too optimistic. Use actual data whenever possible, and be conservative with revenue projections. For new ventures without historical data, research industry benchmarks and competitor performance.

Set aside time each month to compare actual results against forecasts. This review process helps identify patterns and improve future predictions. Remember that forecasting is a skill that improves with practice and consistent attention.

Improving Accounts Receivable

Late payments can cripple a small business. In 2025, entrepreneurs have more tools than ever to streamline the collection process.

Effective AR strategies:

- Implement digital payment systems with automatic reminders

- Offer early payment discounts (2-3% for payment within 10 days)

- Establish clear payment terms before beginning work

- Consider subscription models where appropriate

The average payment time in most industries has decreased to 21 days in 2025, down from 33 days in 2023. This improvement comes largely from automation and improved terms.

Be proactive about following up on late payments. A simple, friendly reminder at the 7-day mark often resolves issues before they become problems. For ongoing clients, consider requiring deposits or milestone payments for larger projects.

Managing Payables Efficiently

Smart management of what you owe others preserves cash without damaging supplier relationships.

Payables best practices:

| Strategy | Benefit |

|---|---|

| Negotiate longer payment terms | Improves cash position |

| Schedule payments strategically | Aligns with cash inflows |

| Use business credit cards wisely | Extends payment window |

| Automate recurring payments | Prevents missed deadlines |

Prioritize payments based on importance to operations and penalties for late payment. Some vendors offer discounts for early payment that exceed current interest rates.

Build transparent relationships with key suppliers. If cash flow issues arise, communicate proactively rather than missing payments without explanation. Many suppliers will work with reliable customers through temporary challenges.

Review all subscription services quarterly. In 2025, the average small business pays for 14 different subscription services, many of which may be underutilized.

Smart Investing for Young Entrepreneurs

Investing wisely is crucial for entrepreneurs to grow wealth beyond their business. The right investment approach can create financial stability and provide capital for future ventures.

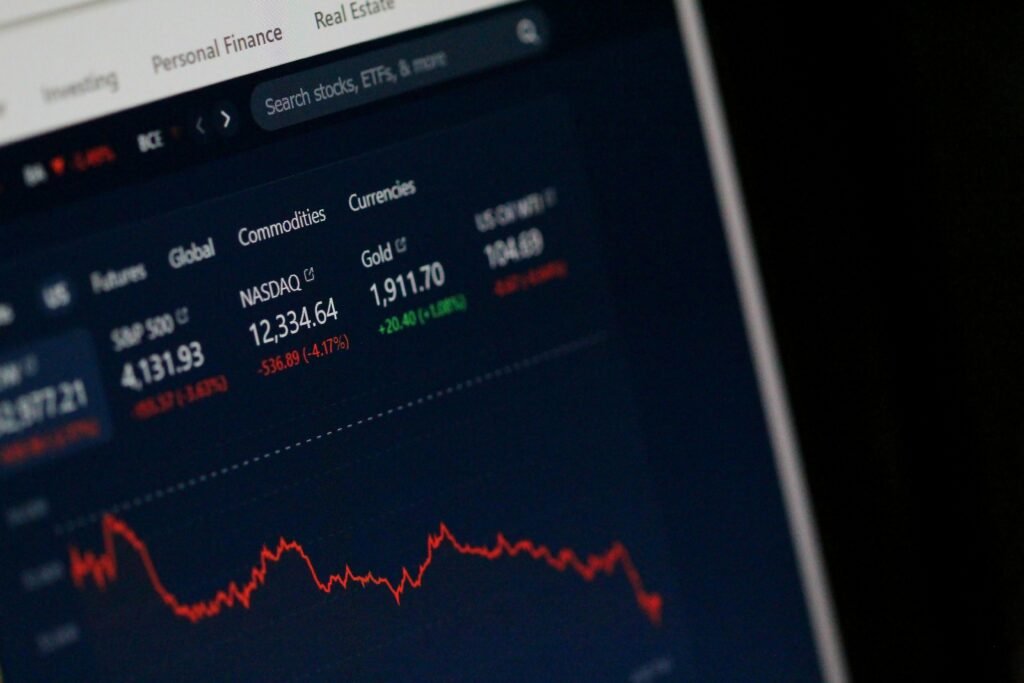

Understanding Investment Options

Stocks represent ownership in companies and can provide growth through price appreciation and dividends. They vary in risk from established blue-chip companies to volatile startups.

Bonds are loans to governments or corporations that pay regular interest. They typically offer lower returns but greater stability than stocks.

Real estate investments include rental properties, REITs (Real Estate Investment Trusts), or crowdfunding platforms. These provide both income and potential appreciation.

Cryptocurrency and digital assets represent newer investment frontiers. While potentially lucrative, these carry significant volatility and risk.

Traditional vs. Alternative Investments:

| Investment Type | Risk Level | Typical Returns | Liquidity |

|---|---|---|---|

| Stocks | Medium-High | 7-10% | High |

| Bonds | Low-Medium | 2-5% | Medium |

| Real Estate | Medium | 5-8% | Low |

| Cryptocurrency | Very High | Highly Variable | Medium |

Building a Diversified Portfolio

Diversification spreads risk across different asset classes. Young entrepreneurs should avoid putting all their capital into a single investment type.

The 2025 market favors a mix of traditional and alternative investments. Consider allocating 60-70% to growth assets and 30-40% to more stable investments.

Sample Portfolio Allocation:

- 40% Stocks (mix of growth and dividend)

- 20% Bonds or fixed income

- 20% Real estate

- 10% Alternative investments

- 10% Cash reserves

Industry diversification matters too. Invest across different sectors like technology, healthcare, and consumer goods to minimize sector-specific risks.

Long-Term vs. Short-Term Investments

Long-term investments (5+ years) benefit from compound growth and weather market volatility. These include retirement accounts, index funds, and quality stocks.

Tax-advantaged accounts like IRAs and 401(k)s provide significant benefits for long-term wealth building. Young entrepreneurs should maximize contributions early.

Short-term investments serve different purposes. They provide liquidity for near-term business opportunities or emergency funds.

Short-term options include:

- High-yield savings accounts

- Money market funds

- Treasury bills

- Short-term bonds

The ideal approach combines both timeframes. Build a foundation of long-term investments while maintaining sufficient liquidity for business opportunities and personal needs.

Leveraging Technology for Financial Success

Today’s financial landscape offers young entrepreneurs powerful digital tools to manage money, save time, and protect assets. These technologies can transform how business finances are handled in 2025.

Using Financial Management Apps

Modern financial apps provide unprecedented control over business finances. Apps like Mint Business, QuickBooks, and the newer CashFlow AI offer real-time tracking of income and expenses.

Mobile banking apps now include features specifically for entrepreneurs. Most allow instant expense categorization, receipt scanning, and automated tax preparation. These features save hours of bookkeeping time each week.

Top Financial Apps for 2025:

- Fiscal: Best for budget forecasting

- Ledger Pro: Excellent tax optimization

- PayPulse: Superior invoice management

- Wealth Tracker: Investment portfolio management

Many of these apps now integrate with business platforms like Shopify and Etsy, automatically importing sales data and expenses.

Embracing AI and Automation

AI-powered financial tools now handle tasks that once required accountants. Smart algorithms can predict cash flow issues before they happen and suggest solutions.

Automated bill payment systems ensure you never miss due dates. These systems can prioritize payments based on cash availability and importance. This prevents costly late fees and damaged vendor relationships.

Investment automation has evolved beyond robo-advisors. New platforms like Capital Mind analyze market trends and adjust portfolios based on your risk tolerance and business goals.

Tax automation software now identifies potential deductions from your business transactions. This typically saves entrepreneurs 15-20% on their tax bills compared to manual preparation.

Cybersecurity Best Practices for Finances

Financial data breaches can devastate a young business. Multi-factor authentication is now standard for financial accounts, but many entrepreneurs still don’t use it consistently.

Essential Security Measures:

- Use unique, complex passwords for each financial account

- Enable biometric verification when available

- Review account activity weekly

- Install updates immediately

Virtual private networks (VPNs) protect financial transactions made on public Wi-Fi. This small investment prevents criminals from intercepting sensitive data.

Encrypted cloud storage services offer secure places to store financial documents. Services like SecureVault and ProtectBox provide bank-level encryption while maintaining easy access to authorized users.

Funding Your Entrepreneurial Journey

Finding money for your business is a critical step that can determine how quickly you grow. In 2025, entrepreneurs have more options than ever to secure the capital needed to turn ideas into successful ventures.

Exploring Startup Financing Options

Small Business Administration (SBA) loans remain a reliable funding source in 2025. They offer lower interest rates and longer repayment terms than traditional bank loans. Requirements include a solid business plan and good credit score.

Self-funding options:

- Personal savings

- Credit cards (use cautiously)

- Home equity loans

- Retirement accounts (with significant tax considerations)

Business grants have expanded significantly, especially for green tech, healthcare innovation, and AI applications. The National Science Foundation offers up to $500,000 for tech startups without taking equity.

Many entrepreneurs choose a mixed funding approach. Starting with self-funding allows retention of complete control while building enough traction to attract outside investors later.

Securing Venture Capital and Angel Investments

Venture capital firms in 2025 focus heavily on sustainable businesses with clear paths to profitability. The average first-round funding has increased to $3.8 million, but competition is fierce.

VC Funding Process:

- Pitch preparation (compelling slide deck required)

- Initial meeting

- Due diligence

- Term sheet negotiation

- Funding

Angel investors typically provide $25,000-$500,000 in exchange for equity. They often offer valuable mentorship along with capital. Angel investor networks have grown 35% since 2023, making them more accessible.

Entrepreneurs should research potential investors thoroughly. Finding investors who understand the specific industry significantly increases success rates. Most entrepreneurs meet with 15-20 potential investors before securing funding.

Crowdfunding Strategies

Crowdfunding platforms have evolved beyond simple donation models. The market now offers four distinct approaches:

| Type | Best For | Average Raise |

|---|---|---|

| Reward | Consumer products | $30,000 |

| Equity | Scalable startups | $250,000 |

| Debt | Established businesses | $125,000 |

| Donation | Social enterprises | $15,000 |

Success requires strong marketing. Campaigns with professional videos raise 105% more than those without. Most successful campaigns reach 30% of their goal within the first 48 hours.

Building an audience before launching is crucial. Entrepreneurs should develop an email list of at least 1,000 interested supporters. Pre-launch marketing typically takes 2-3 months of consistent effort.

The best campaigns offer clear value propositions and transparent use of funds. Updates throughout the campaign increase engagement and funding rates by up to 126%.

Mastering Tax Planning in 2025

Tax planning remains a critical component for young entrepreneurs to maximize profits and minimize liabilities. Effective strategies can save thousands of dollars while ensuring full compliance with current regulations.

Staying Compliant with Tax Regulations

The 2025 tax landscape includes several key changes entrepreneurs must understand. The Small Business Tax Simplification Act now requires quarterly digital filings for businesses earning over $75,000 annually. The IRS has also implemented stricter reporting requirements for digital transactions and cryptocurrency payments.

Young entrepreneurs should stay informed through the IRS Small Business Portal, which provides real-time updates on regulatory changes. Consider using tax compliance software like TaxTrack or CompliantNow that automatically flags potential issues before they become problems.

State-level taxes vary significantly, with 12 states now offering special tax incentives for green businesses and tech startups. Check if your business qualifies for these programs, as they can reduce tax burdens by up to 22% in some locations.

Maximizing Deductions and Credits

Business owners in 2025 can take advantage of enhanced deductions for remote work expenses. Home office deductions now follow a simplified $8.50 per square foot calculation, with a maximum of 300 square feet.

The Innovation Credit provides a 15% tax break on qualifying technology investments made to improve business efficiency. This includes:

- Cloud computing services

- Cybersecurity improvements

- Automation technology

- Sustainable energy implementations

Travel expenses remain deductible, but now require digital documentation through the IRS TravelTrack system. Business meals are still 50% deductible when properly documented with digital receipts.

The Small Business Healthcare Credit now covers up to 65% of employee health insurance costs for businesses with fewer than 25 full-time employees.

Preparing for Tax Season

Start preparation early by implementing a year-round tax management system. Set aside 25-30% of income for taxes to avoid cash flow problems when payments come due.

Maintain separate business and personal accounts to simplify record-keeping and reduce audit risks. Digital receipt management systems like ReceiptBank or Expensify can automatically categorize and store documentation.

Schedule quarterly meetings with a tax professional to review your financial position and make adjustments as needed. This proactive approach typically costs $250-500 per session but saves an average of $3,200 annually through optimized strategies.

Consider tax filing timelines carefully. The standard deadline remains April 15, but entrepreneurs can request an automatic extension to October 15 if needed for more comprehensive preparation.

Building and Protecting Credit

Credit management forms a critical foundation for entrepreneurial success in 2025. A strong credit profile opens doors to better financing options while protecting your business from unnecessary financial risks.

Establishing Strong Credit History

Young entrepreneurs should begin building credit early. Start by opening a business credit card separate from personal finances. Use it regularly for business expenses and pay the balance in full each month.

Register your business with credit bureaus like Dun & Bradstreet to establish a business credit file. This step is often overlooked but proves essential for future growth.

Work with vendors and suppliers who report payments to credit bureaus. Establishing net-30 or net-60 accounts with these partners helps build payment history without taking on debt.

Consider a small business loan or line of credit even if you don’t immediately need the funds. Making consistent payments demonstrates reliability to future lenders.

Improving Your Credit Score

Check business and personal credit reports quarterly through services like Nav or Credit Karma. In 2025’s fast-moving financial landscape, errors can appear unexpectedly and damage your score.

Key factors affecting business credit scores:

- Payment history (40%)

- Credit utilization (30%)

- Length of credit history (15%)

- Credit mix (10%)

- Recent applications (5%)

Keep credit utilization below 30% across all accounts. High utilization signals potential cash flow problems to lenders.

Address negative items promptly through formal disputes. The automated systems used by credit bureaus in 2025 can resolve legitimate disputes within days rather than months.

Managing Business Credit Responsibly

Set up autopay for minimum payments to avoid accidental missed deadlines. Late payments remain the most common credit score damage point for entrepreneurs.

Create a dedicated emergency fund covering 3-6 months of business expenses. This buffer prevents reliance on credit cards during slow periods or unexpected challenges.

Review financing terms carefully before accepting. The increased lending competition in 2025 means entrepreneurs can often negotiate better rates and terms.

Consider secured business credit cards if traditional options aren’t available. These require deposits but build credit history just as effectively.

Monitor business credit card offers for balance transfer opportunities with 0% introductory rates. These can temporarily reduce interest burdens while improving cash flow.

Mitigating Financial Risks

Young entrepreneurs face numerous financial challenges in today’s dynamic business environment. Protecting your venture requires strategic planning and awareness of potential threats that could impact your bottom line.

Understanding Insurance Needs

Business insurance serves as a critical safety net for entrepreneurs. Most startups need general liability insurance to protect against customer injuries or property damage claims. This typically costs $500-1,500 annually depending on your industry and location.

Professional liability insurance (also called errors and omissions) shields you from claims of negligence or inadequate work. This is especially important for service-based businesses.

Property insurance covers your physical assets, while business interruption insurance provides income if operations halt due to covered events.

Cyber liability insurance has become essential in 2025, with premiums averaging $1,400 annually for small businesses. This protects against data breaches and ransomware attacks.

Entrepreneurs should review coverage needs annually as the business grows and risks evolve.

Identifying Common Entrepreneurial Risks

Cash flow problems represent the most common risk for new businesses. Entrepreneurs should maintain a cash reserve covering 3-6 months of operating expenses.

Market risks include competitors, changing consumer preferences, and industry disruptions. Regular market analysis helps entrepreneurs stay ahead of trends.

Operational risks involve supply chain disruptions, equipment failures, or staffing issues. Developing backup plans for critical operations is essential.

Top Financial Risks for Entrepreneurs in 2025:

- Cybersecurity threats (affecting 67% of small businesses)

- Rising interest rates (impacting lending costs)

- Supply chain volatility

- Regulatory compliance costs

- Talent acquisition challenges

Implementing proper accounting systems and regular financial reviews helps identify potential issues before they become crises.

Planning for Economic Uncertainty

Economic downturns are inevitable. Smart entrepreneurs prepare by maintaining low debt-to-income ratios and diversifying revenue streams.

Building flexibility into business models allows for quick pivoting when necessary. This might include flexible supplier agreements or scalable staffing options.

Stress testing your business plan against various scenarios helps identify vulnerabilities. Consider how your business would handle a 20% revenue drop or 15% increase in supply costs.

Emergency funds specifically designated for business use provide critical breathing room during difficult periods. These funds should be separate from personal savings.

Staying informed about economic indicators relevant to your industry helps with proactive planning. The Federal Reserve’s economic projections and industry-specific reports provide valuable insights for 2025-2026 planning.

Developing a Growth Mindset for Financial Success

A growth mindset transforms how young entrepreneurs approach money and business challenges. This perspective views setbacks as learning opportunities and embraces continuous improvement through education, reflection, and persistent effort.

Learning from Financial Mistakes

Financial mistakes happen to everyone, even successful entrepreneurs. The difference lies in how people respond to these errors. Those with growth mindsets examine what went wrong without harsh self-judgment.

When facing a business loss or budget misstep, ask:

- What factors contributed to this outcome?

- What information did I miss or misinterpret?

- How can I implement better systems to prevent similar issues?

Document these lessons. Keep a financial journal where you record mistakes and insights. This practice transforms errors from embarrassments into valuable data points.

Remember that many successful entrepreneurs experienced significant failures. Bill Gates had Traf-O-Data before Microsoft, and Sara Blakely faced numerous rejections before Spanx succeeded.

Staying Motivated and Accountable

Motivation often fades when financial goals require long-term commitment. Creating accountability structures helps maintain momentum during challenging periods.

Effective accountability methods:

- Partner with a financial accountability buddy who understands your goals

- Set specific weekly check-ins with measurable objectives

- Use apps that track progress toward savings or revenue targets

- Join entrepreneur groups where members share challenges and wins

Breaking larger financial goals into smaller milestones provides regular victories to celebrate. Instead of focusing only on reaching $1 million in revenue, celebrate each $10,000 increment.

Continual Financial Education

The financial landscape changes rapidly, especially for entrepreneurs in 2025. Remaining competitive requires ongoing education about emerging trends, technologies, and strategies.

Resources for financial learning:

| Resource Type | Examples | Benefits |

|---|---|---|

| Podcasts | Money For the Rest of Us, BiggerPockets | Learn during commutes |

| Online Courses | Coursera Finance, LinkedIn Learning | Structured curriculum |

| Communities | Reddit’s r/Entrepreneur, Discord groups | Peer insights |

Dedicate 2-3 hours weekly to financial education. This investment yields significant returns through better decision-making and opportunity recognition.

Consider rotating focus areas quarterly. Spend three months deepening knowledge of tax strategies, then shift to investment approaches or cash flow management.

Conclusion

Managing money as a young entrepreneur in 2025 requires both basic financial habits and strategic thinking. The business landscape continues to evolve rapidly, demanding adaptability and financial awareness.

Digital banking, automation tools, and AI-powered advisors offer unprecedented opportunities to streamline financial management. These technologies help entrepreneurs track expenses, optimize cash flow, and make data-driven decisions.

Diversification remains essential for long-term financial stability. Smart entrepreneurs spread investments across different asset classes including traditional stocks, cryptocurrency, and sustainable investment options.

Building an emergency fund covering 6-9 months of expenses provides crucial protection against market volatility. This buffer allows businesses to weather unexpected challenges without taking on high-interest debt.

Networking with mentors and fellow entrepreneurs creates valuable connections for knowledge sharing and potential partnerships. These relationships often lead to new opportunities and insights.

Tax planning should be proactive rather than reactive. Understanding available deductions, credits, and strategies helps minimize tax burdens legally while maximizing business profits.

The most successful entrepreneurs maintain balance between reinvesting in business growth and personal financial security. This dual focus creates sustainability for both the venture and the individual.

Financial literacy is not a destination but a journey. Continuing to learn about money management, investment strategies, and economic trends positions entrepreneurs for lasting success in 2025 and beyond.